Charles Schwab’s $655 billion asset management arm is launching its first crypto-related exchange-traded fund (ETF). It is anticipated that the new ETF will start trading on the NYSE Arca exchange this week.

Charles Schwab’s first Crypto-Related ETF Launched

Schwab Asset Management, a subsidiary of The Charles Schwab Corp., announced last week the launch of the Schwab Crypto Thematic ETF (NYSE Arca: STCE), calling the new product “its first crypto-related ETF.”

Charles Schwab, a leading American bank, brokerage and financial service company, is one of the most important. According to the website, Schwab Asset Management has more than $655 billion of assets under its management. According to its website, it is currently the third-largest provider of index mutual funds as well as the fifth-largest provider of exchange traded funds (ETFs).

The Schwab Crypto Thematic ETF will open for trading starting on or around Aug. 4, according to the announcement.

The fund is designed to track Schwab Asset Management’s new proprietary index, the Schwab Crypto Thematic Index.

According to the fund’s prospectus filed with the U.S. Securities and Exchange Commission (SEC) Friday, the Schwab Crypto Thematic ETF is “designed to deliver global exposure to companies that may benefit from the development or utilization of cryptocurrencies (including bitcoin) and other digital assets, and the business activities connected to blockchain and other distributed ledger technology.” Furthermore, “The fund is non-diversified, which means that it may invest in the securities of relatively few issuers,” the company warned.

Notes from the announcement:

This fund does not invest directly in digital assets or cryptocurrency. The fund invests in businesses listed on the Schwab Crypto Thematic Index.

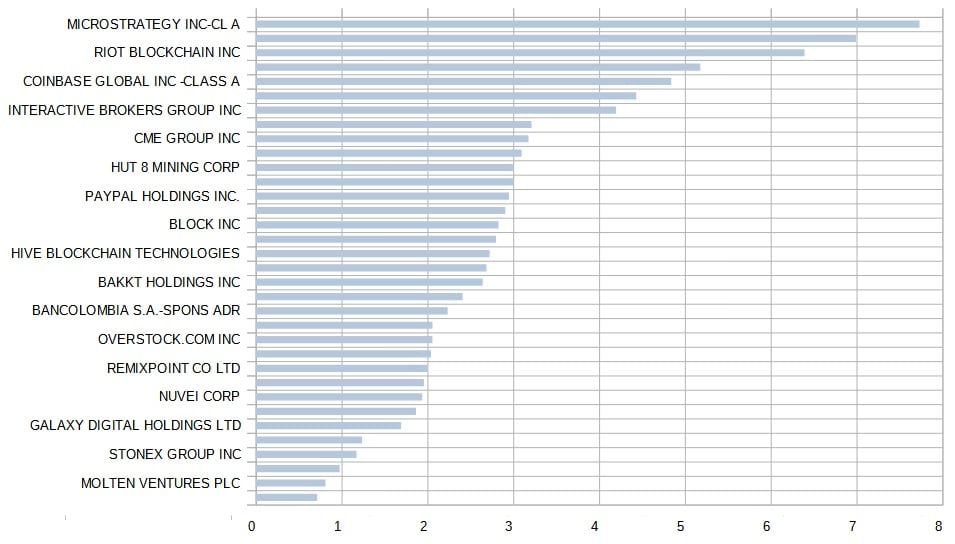

The Schwab Crypto Thematic Index’s constituents as of July 29 include Microstrategy, Marathon Digital Holdings, Riot Blockchain, Silvergate Capital, Coinbase Global, Robinhood Markets, Interactive Brokers, Nvidia, CME Group, Bitfarms, Hut 8 Mining, International Exchange, Paypal, SBI Holdings, Block Inc., Monex Group, Hive Blockchain, Internet Initiative Japan, Bakkt Holdings, NCR Corp., and Bancolombia.

David Botset (Managing Director and Head of Equity Product Management and Innovation, Schwab Asset Management) commented:

The Schwab Crypto Thematic ETF aims to give investors access to the expanding global cryptocurrency ecosystem, while also offering the transparency and low costs that advisors and investors expect from Schwab ETFs.

The SEC has yet to approve a Bitcoin spot ETF, despite having approved several other bitcoin-futures exchange traded funds. In June, Grayscale Investments, the world’s largest digital asset manager, filed a lawsuit against the SEC after the securities regulator rejected its application to convert its flagship bitcoin trust, GBTC, into a spot bitcoin ETF.

Do you have any thoughts about Schwab Asset Management’s launch of its first crypto-related ETF Comment below.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThe information contained in this article is intended to be informative. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com doesn’t offer investment, tax or legal advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.