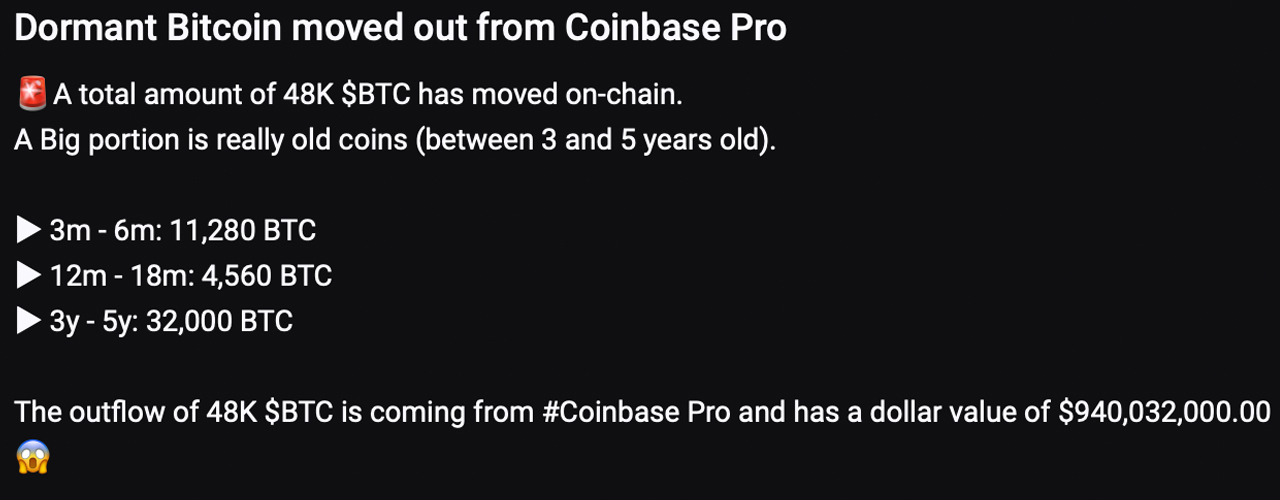

Cryptoquant researchers discovered that Coinbase Pro was the source of 48,000 bitcoin. According to the researcher’s summary of the situation, a large portion of the funds were old coins.

Whale Transfers 48,000 Bitcoin in Coiled Market

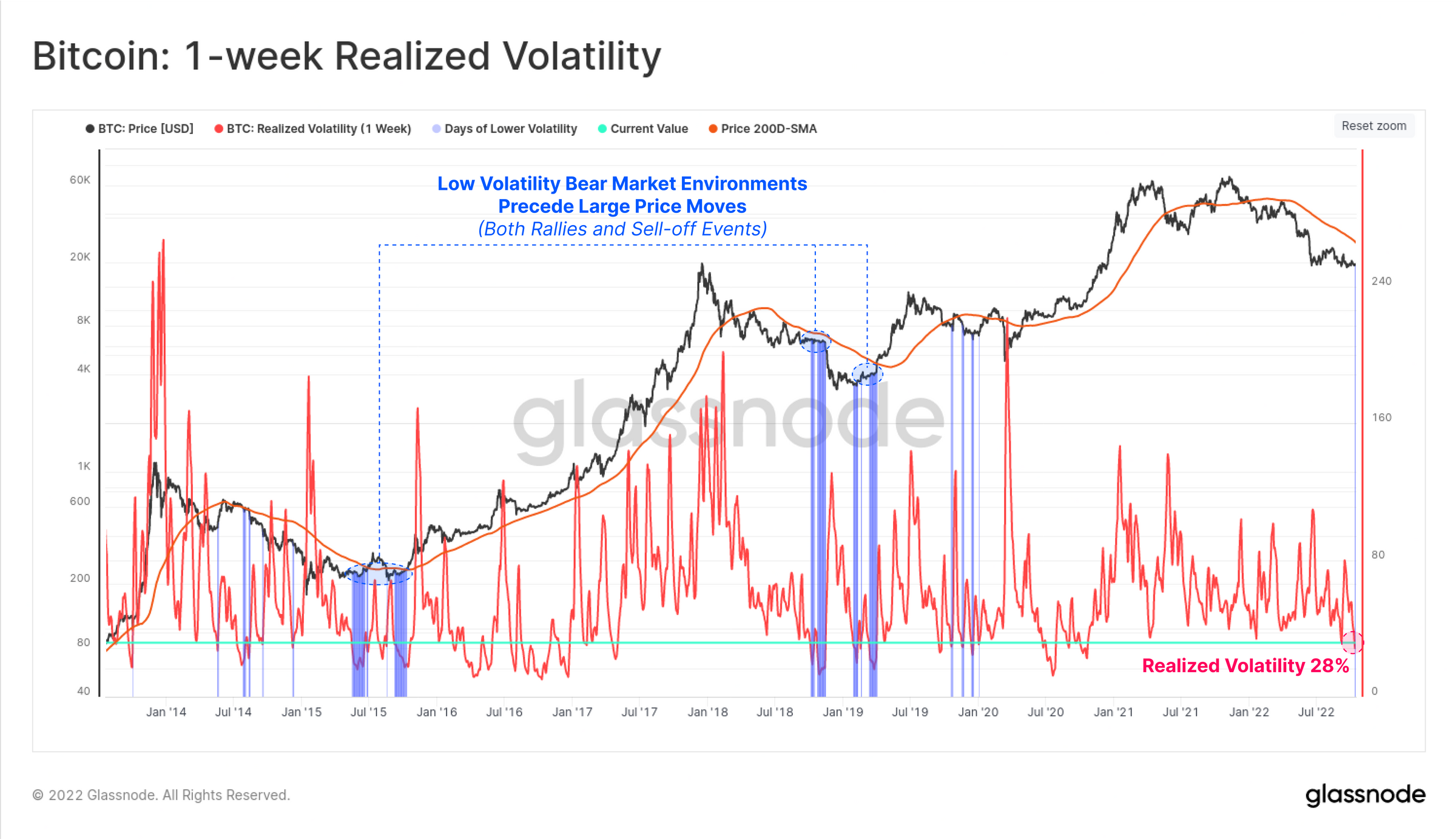

Bitcoin (BTC), which has been trading below $20K and sideways since then, is being observed by observers to see a variety of coins onchain. This onchain movement is occurring at a time of market volatility. For instance, the latest Glassnode Insights report called “A Coiled Spring,” expects some bitcoin price fluctuations to occur in the near future.

“The bitcoin market is primed for volatility, with both realized and options implied volatility falling to historical lows,” Glassnode wrote on October 17. “Futures open interest has hit new all-time-highs, despite liquidations being at all-time-lows. Volatility is likely on the horizon, and Bitcoin prices rarely sit still for long.”

Researchers from Cryptoquant, a crypto analysis platform, were there the next day. tweetedOn Tuesday, 48,000 bitcoins that were still inactive moved ontochain. “Dormant bitcoin moved out from Coinbase Pro,” Cryptoquant said on Twitter. “The outflow of 48K BTC is coming from Coinbase Pro and has a dollar value of [$940 million].”

Cryptoquant said that a “big portion” of the onchain spending stemmed from batches of really old bitcoins, at least three to five years in age. Researchers estimate that roughly 32,000 BTC were aged between three and five years. “Further investigation is needed to conclude whether it’s an exchange in-house flow, sent to a new wallet, or just a clean outflow,” Cryptoquant detailed on Tuesday.

Cryptoquant updated the original post to say that Coinbase had received 8,000 BTC shortly thereafter. “The transactions were partially split into batches of 122 BTC. We’ve seen this multiple times during the 2021 bull run, right? Ahem institutions,” Cryptoquant added.

11-Year-Old ‘Sleeping Bitcoins’ Wake After Years of Slumber

In addition to the 48,000 coins moving onchain with a great majority being dormant bitcoins, a few addresses from 2011 have sent a few batches of so-called ‘sleeping bitcoins’ this month. Btcparser.com spotted sleeping bitcoins leaving an address they created in May 2011. Then, the blocks were moved to October 10, 2022 at block height 758.046.

A dormant account created on October 24, 2011 was transferred 40 BTC that day. A batch of 10.29 bitcoins, created from an address on September 20th 2011, was then transferred seven days later.

Let us know your thoughts on the recent Bitcoin spends. Please share your views on this topic in the comment section.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. This article does not contain any information, products, or advice that can be used to cause or alleged result in any kind of damage.