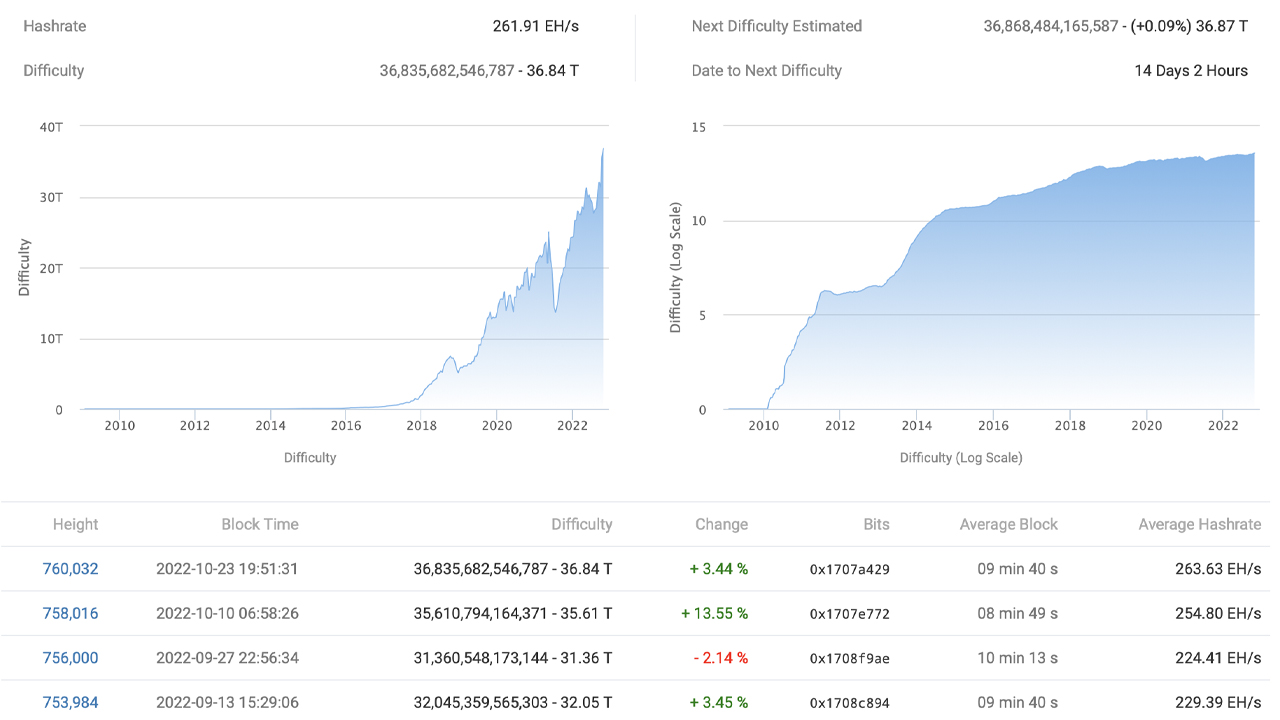

Bitcoin experienced a new mining difficulty increase on Sunday October 23rd, 2022 with block height at 760.032 increasing 3.44%. This means that not only is it 3.44% harder to find a bitcoin block subsidy, the network’s mining difficulty has also reached another all-time high (ATH) by tapping 36.84 trillion.

Bitcoin’s Mining Difficulty Adjusts Upwards by 3.44%, Now at 36.84 Trillion

This weekend, Bitcoin’s (BTC) mining difficulty jumped 3.44% higher than the height miners dealt with during the past two weeks or the last 2,016 blocks. The network’s difficulty has reached a lifetime high at 36.84 trillion, following the 3.44% shift on Sunday evening (ET).

The rise on Sunday follows the 13.55% increase Bitcoin’s difficulty recorded on October 10, 2022, at block height 758,016. The 13.55% increase was 2022’s largest Bitcoin difficulty rise, and it took place as BTC’s total hashrate reached an ATH on October 11, 2022, at block height 758,138.

On October 11, the network’s hashrate reached 325.11 exahash per second (EH/s) which equates to three hundred twenty-five quintillion one hundred ten quadrillion hashes per second.

As Bitcoin.com News reported on October 21, the network’s hashrate has been oblivious to the difficulty’s lifetime high and the lower BTC prices, as Bitcoin’s computational power remains stronger than ever.

Currently, BTC’s hashrate is coasting along at 260 to 275 EH/s. Because the 2,016 blocks had been mined quicker than the average over the past two weeks, Sunday’s difficulty was higher.

Prior to the shift, BTC’s block time average on Sunday, October 23, 2022, at 5 p.m. (ET) was around 8:79 minutes. The October 21 mining update that highlights the network’s hashrate strength noted that block intervals were between 8:30 minutes to 9:35 minutes.

Satoshi’s difficulty retargets attempt to keep block intervals at an average rate of ten minutes per block. If there are less than 2,016 blocks between difficulty targets, the difficulty level will go up. However, if mining takes longer than two weeks (more then two), the difficulty level will drop.

Today, 60.36% of global hashrate is held by the three largest bitcoin mining pool, Antpool USA, F2pool, and Foundry USA. In the three-day period, 444 BTC bitcoin blocks have been mined and Foundry has discovered 113.

Antpool was able to capture 90 blocks, while F2pool discovered 65 blocks. Twelve mining pools have been identified that are directing SHA256 hashrate towards the BTC chain. 4.05% belongs to unidentified hashpower or stealth miners.

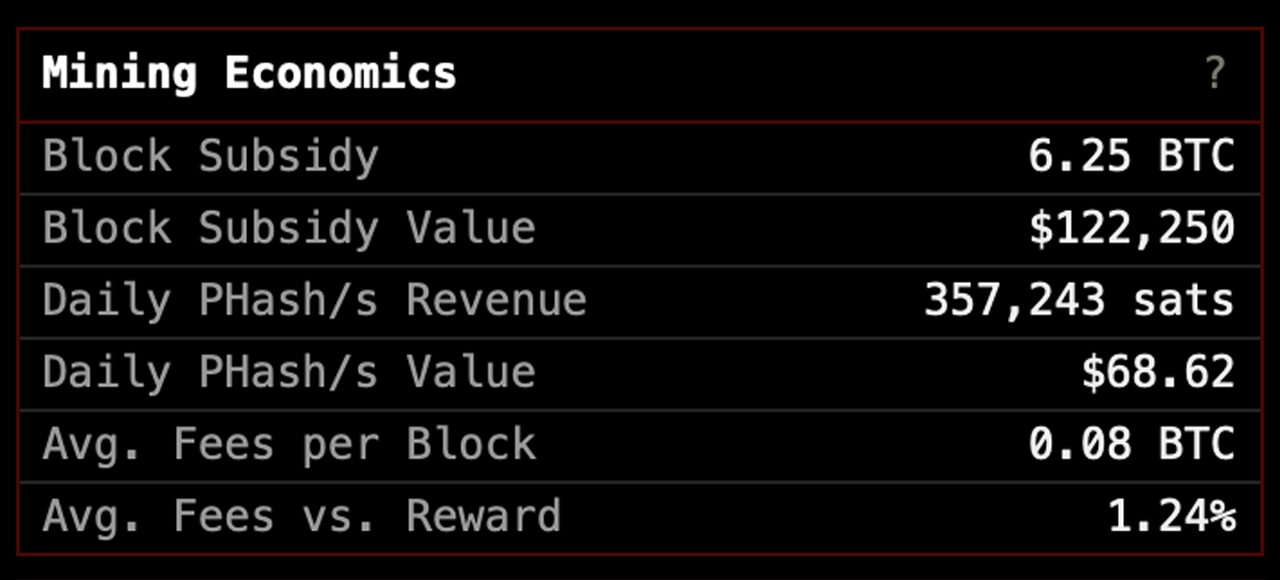

At the time of writing a block subsidy’s USD value is $122,250, and the next expected mining difficulty retarget is due on or around November 6, 2022. There’s roughly 79,900 blocks left until the next block subsidy halving which is estimated to occur between February 24, 2024 and April 20, 2024.

What do you think about Bitcoin’s network difficulty reaching an all-time high on Sunday, October 23, 2022? Comment below and let us know how you feel about the subject.

Images CreditsShutterstock. Pixabay. Wiki Commons

DisclaimerThis article serves informational purposes. It does not constitute an offer, solicitation, or recommendation of any company, products or services. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused or alleged caused by the content or use of any goods, services, or information mentioned in the article.