Bitcoin has been experiencing some volatility over today’s trading session as the price of BTC touches critical resistance levels. Although the market capitalization of Bitcoin is number one, it has been positively reacting to macroeconomic variables. However, as this weekend draws near, lower levels could lead to sudden price movements.

Bitcoin (BTC), currently trading at $19,000. It has made a 1% profit over the last 24hrs and suffered an 8% drop in value during the past week. Bullish price action was seen in cryptocurrency after U.S. released important economic metrics. However, the rally was brief as BTC fell below a group of selling orders around $20,400.

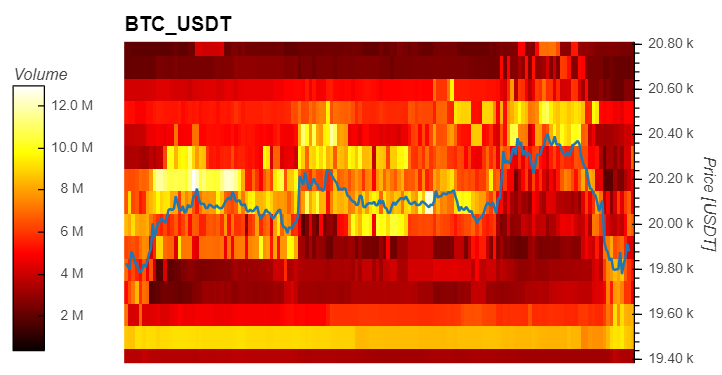

Material Indicators’ data shows how Binance liquidity has been changing with the Bitcoin price. As Bitcoin approaches critical levels, large players are placing buy-and-sell orders.

As seen in the chart below, today’s rejection was triggered by a stack of around $20 million in asks orders as Bitcoin trended to the upside. The price has seen a similar pattern during this week with BTC’s price trending upwards only to experience overhead resistance triggered by a spike in ask liquidity.

The opposite is true for buy orders. $19,500 (or bid) has shown the highest liquidity with $19,000 and $19,000 displaying relatively stable levels. These levels will be critical as they will operate as support and prevent BTC’s price from reaching a new yearly low if the market attempts to trend lower.

Material Indicators indicate that there has been an increase in the selling pressure of large players. The higher asking prices for orders over $1 million and more than $100,000 in the shorter-term have been rising and may be an obstacle to potential upside.

The weekend in the United States will extend to Tuesday because of a holiday. As low volumes influence price action, this can lead to volatility spikes.

Bitcoin: What Are the Chances?

Justin Bennett provided additional data that indicates the possibility of a rejection by the U.S. Dollar as it attempts to move above a critical flat base. This may lead to the reclaiming of levels that were last reached in 2003.

However, the currency has been unable to clear the area above 109, as measured by the DXY Index, and a “fakeout” might be in play. The U.S. dollar has been negatively correlated to Bitcoin and the cryptocurrency market. The rejection of Bitcoin and the crypto market might favor the emerging asset class. Bennett said:

So far, it looks like the $DXY was “wrong”. There may be a pullback up to 107 next Monday if the trend line is broken. This would be very bullish for cryptocurrency in the near term. However, the USD index will eventually reach 112-113 or higher.