Data from the blockchain shows that Bitcoin whales are still putting selling pressure on crypto markets, as its price drops to below $20k.

The Bitcoin Exchange Whale Ratio has risen to high values

CryptoQuant posted that the US CPI announcement caused the market to crash 10% within hours.

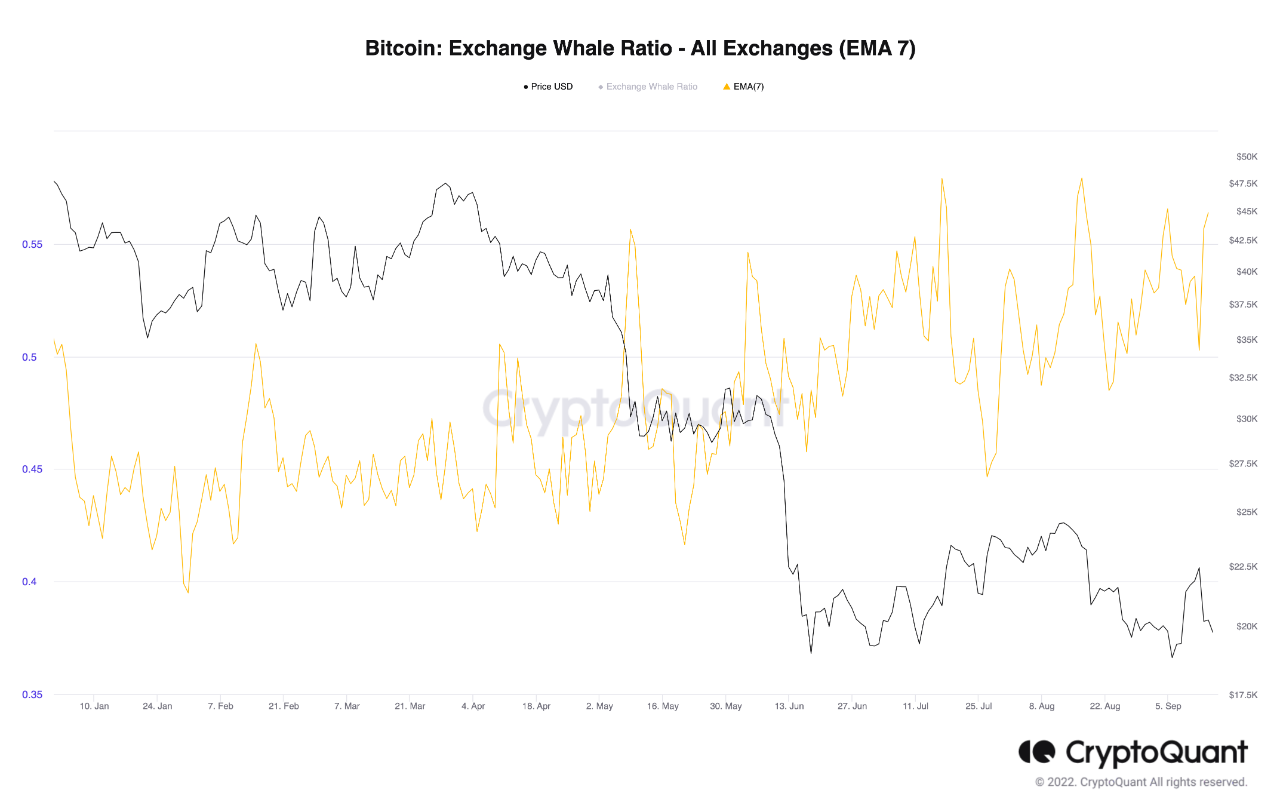

The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top 10 Bitcoin transactions to exchanges, to the total exchange inflows.

Since the ten largest transfers to exchanges are usually from the whales, this metric’s value tells us how much of the total inflows are coming from these humungous holders.

If the ratio’s value is high it could indicate that whales account for large amounts of transactions made to the exchanges. A trend like this can signal a loss of members from the cohort.

Below is a chart to show the Bitcoin exchange whale rate (EMA 7) for the years 2022 and so far.

CryptoQuant: The metric's value seems to be quite high these days.| Source: CryptoQuant

You can see that the Bitcoin Whale ratio’s 7-day exponentially moving average has been increasing recently in the graph. This indicates that these holders have been responsible for much of the activity seen on exchanges in recent months.

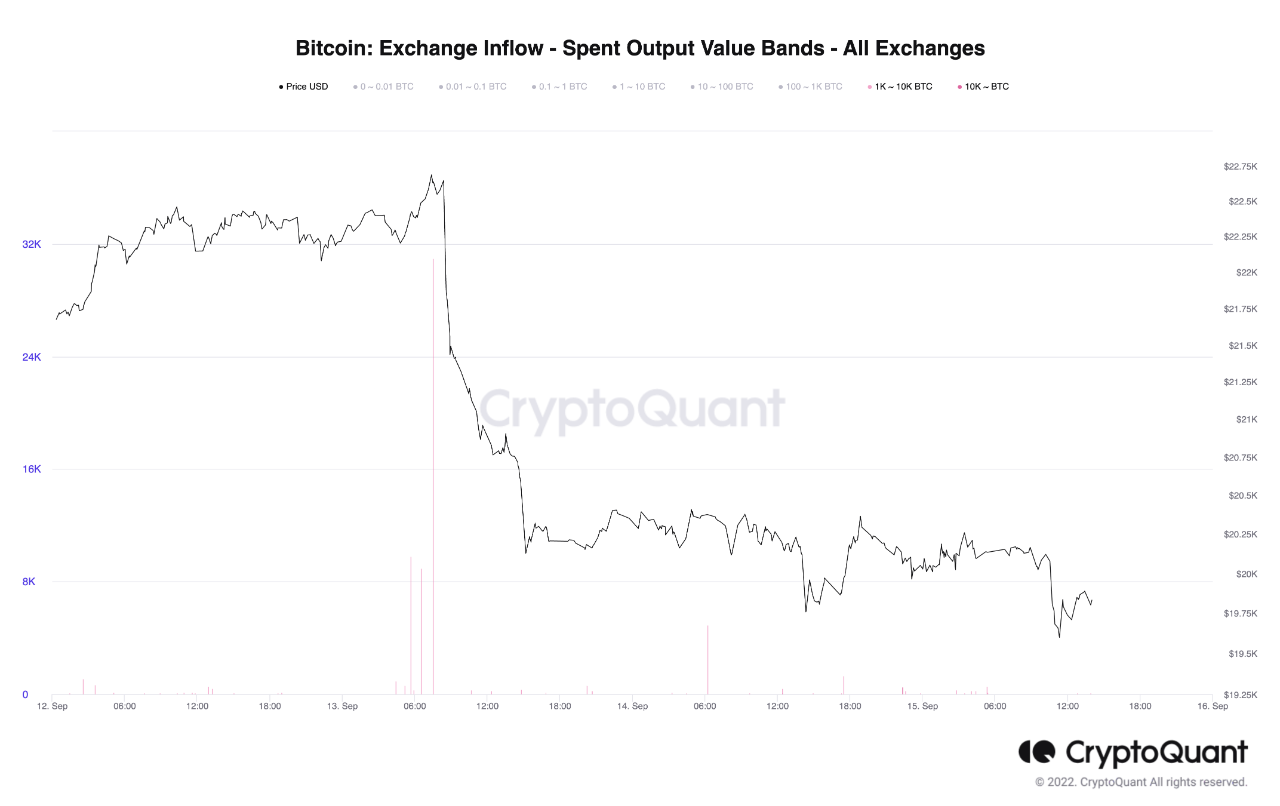

The Spent Output Val Bands is another indicator that shows us how individual holders contribute to market inflows. Based on their BTC holdings, investors are placed in these cohorts.

This chart shows how this trend has been for 1k-10k BTC holders and 10k+ BTC holders.

Source: CryptoQuant| Source: CryptoQuant

This graph shows that the two groups of whales, those holding 1k-10k BTC as well as those who have 10k BTC or more, actively participated in the recent exchanges.

It was just before the Bitcoin’s recent plunge in value that brought it down to $20k, when there were some large spikes.

The quant in the post notes that later today’s values of the exchange whale ratio can be important in judging how severe its moving average is going to be.

BTC price

At the time of writing, Bitcoin’s price floats around $19.7k, down 6% in the past week.

Source: BTCUSD on TradingView| Source: BTCUSD on TradingView

Featured image by Andrew Bain at Unsplash.com. Charts and charts provided by TradingView.com. CryptoQuant.com.