According to on-chain data, Bitcoin miner reserve showed an abrupt spike in recent months. This suggests that miners may be currently buying more crypto.

Bitcoin Miner Reserve Grows, Trend In Accumulation Continues From Last Year

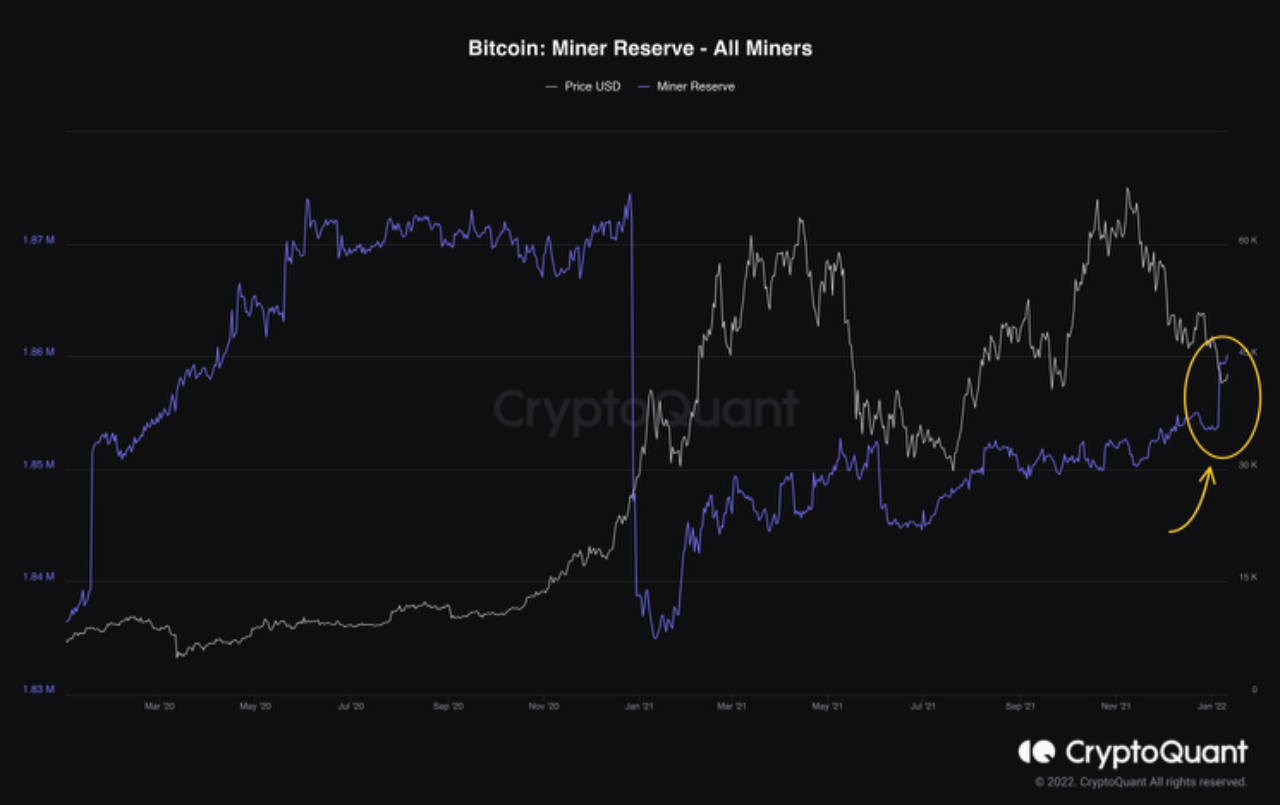

A CryptoQuant analyst noted that BTC’s miner reserves have been in an uptrend. It seems that this is a continuation the accumulation trend of last year.

The “miner reserve” is an indicator that tells us the total amount of Bitcoin currently stored in the wallets of miners.

The trend of the metric in favour up means that miners’ inventories are increasing as they accumulate more coins. A trend like this can boost the value of the coin because it means that miners are increasing their BTC.

Conversely, the indicator’s downtrend indicates that miners have begun to withdraw their Bitcoin. As miners typically sell large amounts, this trend can be bearish on the cryptocurrency’s price.

Related reading: Why sovereign nation states might begin acquiring bitcoin in 2022| Why Sovereign Nation States May Begin Acquiring Bitcoin In 2022

Below is a chart that illustrates the changes in BTC miner reserve over time:

The indicator value shows a strong uptrend. Source: CryptoQuant| Source: CryptoQuant

You can see that the miners reserve has steadily increased since May, as you can see from the graph. The metric saw a dramatic spike in value when Bitcoin’s price dropped to $39k a few days ago, as miners purchased the drop.

Jack Dorsey’s Block To Democratize Bitcoin Mining With Open Source Mining System| Jack Dorsey’s Block To Democratize Bitcoin Mining With Open Source Mining System

Since they must sell some of their mined products to continue operating, miners have always been big sellers. However, as BTC’s price has risen, and their machines have gotten more advanced and efficient, miners have started selling lesser as it’s enough to sustain electricity and other mining costs.

For a few years, miners have been moving towards being hodlers, despite their original role of selling pressure on the market. Long-term, this can prove to be extremely bullish on the coin’s price.

BTC Prices

At the time of writing, Bitcoin’s price floats around $42k, down 0.6% in the last seven days. In the last month, crypto lost 10%.

Below is a chart showing the recent trend of BTC’s price over the past few days.

BTC prices plunge after breaching above $44k Source: BTCUSD at TradingView| Source: BTCUSD on TradingView

BTC was able to climb as high as $44.4k with its latest move up. But today, the crypto has again fallen, undoing all the gains from the past few days.

Unsplash.com featured image, Charts from TraadingView.com and CryptoQuant.com charts