Bitcoin could be returning to its lowest point in the current range. BTC may be stuck for several months and not be able to move higher. The volatility of global financial assets has declined due to uncertainty and macroeconomic factors.

Bitcoin (BTC). The price of Bitcoin (BTC), at the time this article was written, is $19,400. It has experienced sideways movements across timeframes and trades with sideways trading. Earlier today, the cryptocurrency hinted at more gains, but bulls have been unable to sustain momentum, surrendering BTC’s profits from last week.

Bitcoin Quiets, The Macro Forces Take the Wheel

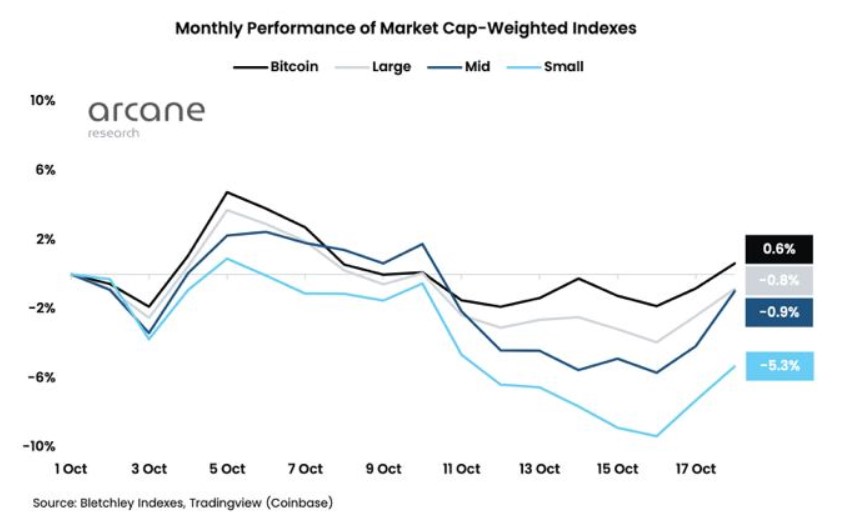

Arcane Research claims that Bitcoin didn’t see any clear direction during October. In terms of asset movements sideways, the cryptocurrency was the top-performing asset.

This chart shows that the benchmark cryptocurrency has made a profit of 0.6% over the past thirty days. However, other crypto assets have been trending slightly downwards. The worst performer was the smaller tokens, which suffered a loss of 5% in October.

The smaller cryptocurrency cryptocurrencies suffer the most from uncertain markets and are usually the first to be affected. Investors often seek shelter in Bitcoin and other stablecoins as they can measure by the BTC Dominance or the USDT Dominance. After a dramatic decline in October, these metrics are trending up.

BTC dominance and stablecoin have risen in tandem, indicating that the market is entering a new stage of uncertainty. This will lead to more price volatility until the next macroeconomic event. Arcane Research noted the following on BTC’s current price action:

There is no obvious trend for October as the cryptocurrency market remains flat. Bitcoin and ether are gaining market shares relative to the other large caps this week, while small caps are struggling (…). The cryptocurrency market continues to be closely aligned with that of the stock markets this month. The correlation between Bitcoin and Nasdaq is at an all-time high of 1%.

What happens when BTC goes quiet?

Santiment also has additional data that suggests Bitcoin whales may be buying Bitcoin at current levels. Bitcoin is nearing its 2017 record high. These levels provide long-term investors with the best chance of increasing their holdings.

As BTC’s price trends sideways, Bitcoin addresses holding between 10,000 to 100,000 BTC reached their highest level since February 2021. The cryptocurrency was about to enter price discovery mode after a bull run which saw it rise from $20,000 to $30,000.

The research company noted:

(…) addresses holding 10 to 100 $BTC have reached their highest amount of respective addresses since Feb, 2021. Utility should rise with increasing numbers of addresses in a network.

Despite these data, it is possible that the macroeconomic environment might not be favorable for a Bitcoin rally, leading to long periods of accumulation around the 2017 ATH, and its yearly lowest of $17,000.