Bitcoin saw some relief over the last few days, with a 4.5% profit within 24 hours. After recovering from $39,000 lows, the first cryptocurrency by market cap traded at $42,947.

Similar Reading| TA: Bitcoin Bounces To $42K, Why BTC Could Recover To $43.5K

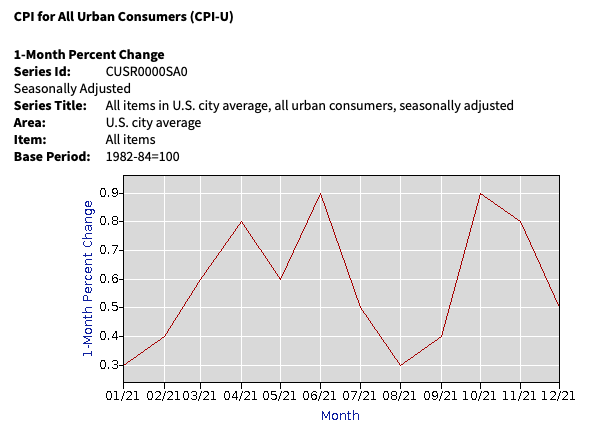

Recent bullish price action follows the U.S. Consumer Price Index report (CPI); this metric is a hot topic for all investors. The CPI is used to calculate inflation in U.S. Dollars. It printed a 7% figure for December 2021.

The metric recorded a percentage below investors’ expectations and was mostly one of the reasons Bitcoin saw a quick recovery. It was at its highest level in 40 years, which suggests that the issue will be a top priority for financial institutions through 2022.

The individual inflation data shows a very different picture. Many sectors have seen double-digit increases in their annualized rates. These include medical care at 37.3% and transportation at 21%. Energy is at 29.3%.

Inflation misery all in one graph! The US inflation rate of 7% has been the highest since 1980s. The monthly price rises are higher than anticipated. Prices rise for used cars and food as well as clothing. (Chart via @MOstwald1) pic.twitter.com/mJOCun6UOK

— Holger Zschaepitz (@Schuldensuehner) January 12, 2022

U.S. Federal Reserve chairman Jerome Powell suggested that the Federal Reserve might taper and increase interest rates because of inflation. At the moment, inflation fears have been reduced, but could soon return to justify a shift in the financial institution’s monetary policy. Yuya Hashigawa, an analyst at Bitbank.

(…) if the CPI and PPI turn out to be higher than the market expects, they could rekindle inflation fear and, in turn, also justify the first-rate hike as early as this March. According to the CME’s FedWatch, almost 70% of the market participants are expecting the March rate hike, so bitcoin may be able to defend $40k in case of another sell-off, but it certainly is not the time for optimism in the short run.

Bitcoin, more blood for the short-term?

The analyst sees $44,000 to $48,000 as important short-term resistance levels. Bitcoin may reach its highest point, which is near $50,000, if the analyst breaks the former. If it does not, then the cryptocurrency could move back to the lowest levels, just as it did in recent weeks.

Material Indicators’ data shows that Bitcoin is not being supported below the current level. More than $12 million worth of bid orders have been placed in the range $39,000-$40,000. Around the same number are ask orders in the region $44,000-45,000.

This is a sign of market uncertainty. However, Bitcoin continues to maintain bullish price action. If the inflation metrics in the U.S. continue to trend to the downside or below investors’ expectations, the first crypto could resume its upside trend with more strength in the coming months.

Related reading: President Bukele Prognoses BTC at $100k In Hope that More Countries Will Adopt it As A Legal Tender| President Bukele Predicts BTC At $100k With Hope That More Countries Adopt It As Legal Tender

Jan Wüstenfeld, analyst for CryptoQuant, wrote the following on the CPI and its potential impact on BTC’s price in the long term:

(…) if it (inflation) continues coming down in the next months this would be the perfect excuse for the FED to reverse its hawkish stance, which would be bullish for Bitcoin.