Two days ago, U.S. president Joe Biden was criticized for claiming inflation in America hasn’t increased during the past few months. “I’m telling the American people that we’re going to get control of inflation,” Biden stressed during his “60 Minutes” interview that aired on Sunday night. Amid Biden’s claims, ahead of the next Federal Reserve meeting on Wednesday, the U.S. Dollar Index (DXY) crept up to the 110.776 region. Meanwhile, a recent report published by CCP-backed Global Times is pressing for de-dollarization as the U.S. dollar’s rise “might be the beginning of another nightmare” for “many countries in the world.”

Biden Notifies the US that Gas Prices Have Reverted to March Levels Following His Administration’s Depletion of US Strategic Petroleum Reserve by 193 Million Barrels

The United States has experienced terrible inflation, but Joe Biden the U.S. president has assured the American people that they will manage it. His commentary during a “60 Minutes” interview was aired a few days before the Federal Reserve meets to hike the benchmark interest rate by 75 or 100 basis points (bps).

Biden took a lot of flak from economists and market strategists after he noted that he believes the country’s inflation rate hasn’t spiked for months. Furthermore, the U.S. president has been taking pride in the fact that America’s gas prices have dipped.

“Folks, gas prices are now back to levels they were at in early March,” Biden tweetedOn Tuesday. “That means nearly all of the increases since the beginning of Russia’s war in Ukraine have been wiped out.”

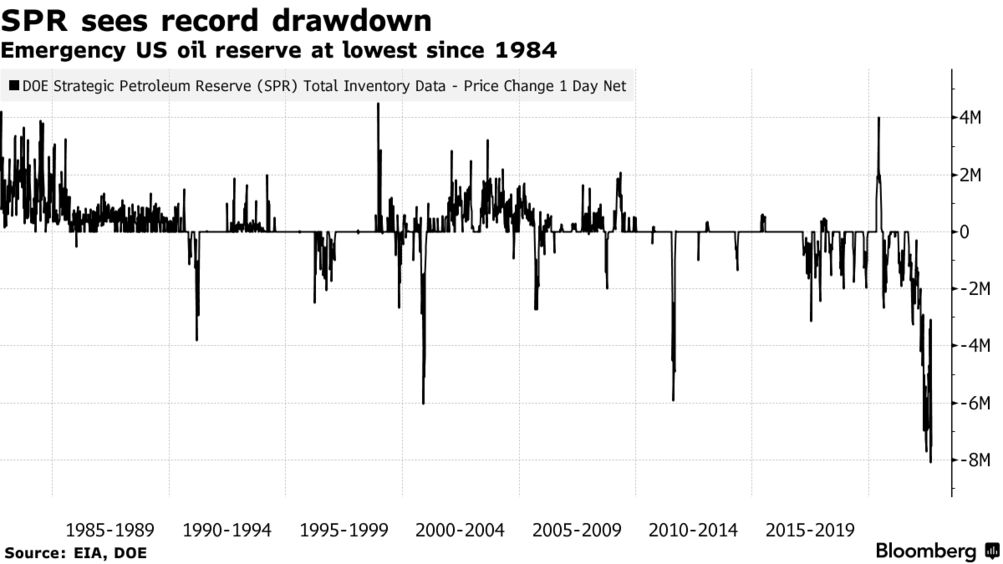

However, the Biden administration hasn’t really explained why gas prices have dropped amid the Ukraine-Russia war and the highest inflation in 40 years. The U.S. president has failed to mention that petroleum prices in the U.S. have dropped because he’s been tapping into the U.S. Strategic Petroleum Reserve (SPR). Biden claims that gas prices have returned to the levels of March early, but he fails to mention the fact that the SPR was drained by the Obama administration on March 31, 2022.

In fact, the SPR is at its “lowest level since 1984,” according to various reports published nationwide. There is still a war in Ukraine with Russia and Europe continues to face a major energy crisis. Biden made a complaint about the carbon emissions. However, SPR has decreased from 640million barrels of crude oil to 450million barrels. Furthermore, despite the U.S. funneling billions to Ukraine, Russian president Vladimir Putin detailed this week that he is not backing down, vowing to use “all means available” to win.

While DXY Creeps Higher, CCP-Backed Editorial Claims US Bureaucrats Have Committed ‘Financial Looting’ and a Strong Dollar Is a ‘Nightmare’ for Other Nations

Moreover, a CCP-backed Global Times opinion editorial is urging foreign nations to lean toward de-dollarization as the rising dollar may become “the beginning of another nightmare.” The editorial was published the day before the U.S. Federal Reserve meets to raise the federal funds rate. “A super strong U.S. dollar and the fall of other currencies will, to a certain extent, ease the scorching inflation in the U.S. economy, but the world will have to pay for it,” the Global Times says.

Since the end of World War II and the start of the Bretton Woods agreement, the Global Times opinion piece author claims U.S. bureaucrats have committed “financial looting” and have exported crises to foreign nations. After the U.S. Dollar Index (DXY) dropped for three consecutive days, the DXY has risen on Wednesday to 110.776 ahead of the Fed’s meeting.

DXY measures six fiat currencies. The greenback’s strength has increased over the last few months. The Global Times editorial says America’s problems will not be solved by the Fed and Washington because these entities are not willing to see the “root cause.”

“If people dig the root cause, this is an inevitable consequence of U.S.’ blind and unlimited money printing to temporarily maintain ‘prosperity,’” the opinion editorial notes. “In other words, in the face of the deep-seated problems exposed by the 2008 financial crisis, Washington has been powerless, and unwilling as well, to solve them.” The author adds:

While the political elites in Washington boast of the ‘myth of the American system’ and take credit for ‘alleviating the crisis,’ thousands of poor families around the world are being trampled by them.

What do you think about Biden’s claim regarding gas prices in the U.S. while he depletes the SPR? Do you agree with the Chinese state media editorial that claims a strong dollar is a disaster for foreign countries? We’d love to hear your opinions on the subject below in comments.

Images CreditsShutterstock. Pixabay. Wiki Commons. Bloomberg. Tradingview DXY.

DisclaimerInformational: This article is not intended to be a solicitation or offer to sell or buy any product, service, or company. Bitcoin.com is not a provider of investment, tax, legal or accounting advice. The author and the company are not responsible for any loss or damage caused by the content or use of any goods, services, or information mentioned in the article.