Over the past 30 days, Bitcoin’s hashrate has been coasting alongside on the highest ranges ever recorded through the community’s lifetime. Bitcoin’s value improved just lately however it’s nonetheless down 38% from the crypto asset’s excessive, making bitcoin much less worthwhile to mine. Nevertheless, bitcoin mining remains to be worthwhile, in distinction to 10 years in the past, when the main crypto asset’s worth crashed under the price of manufacturing.

Bitcoin’s Worth Is 38% Decrease Than It’s All-Time Excessive, Bitcoin Miners Nonetheless Revenue

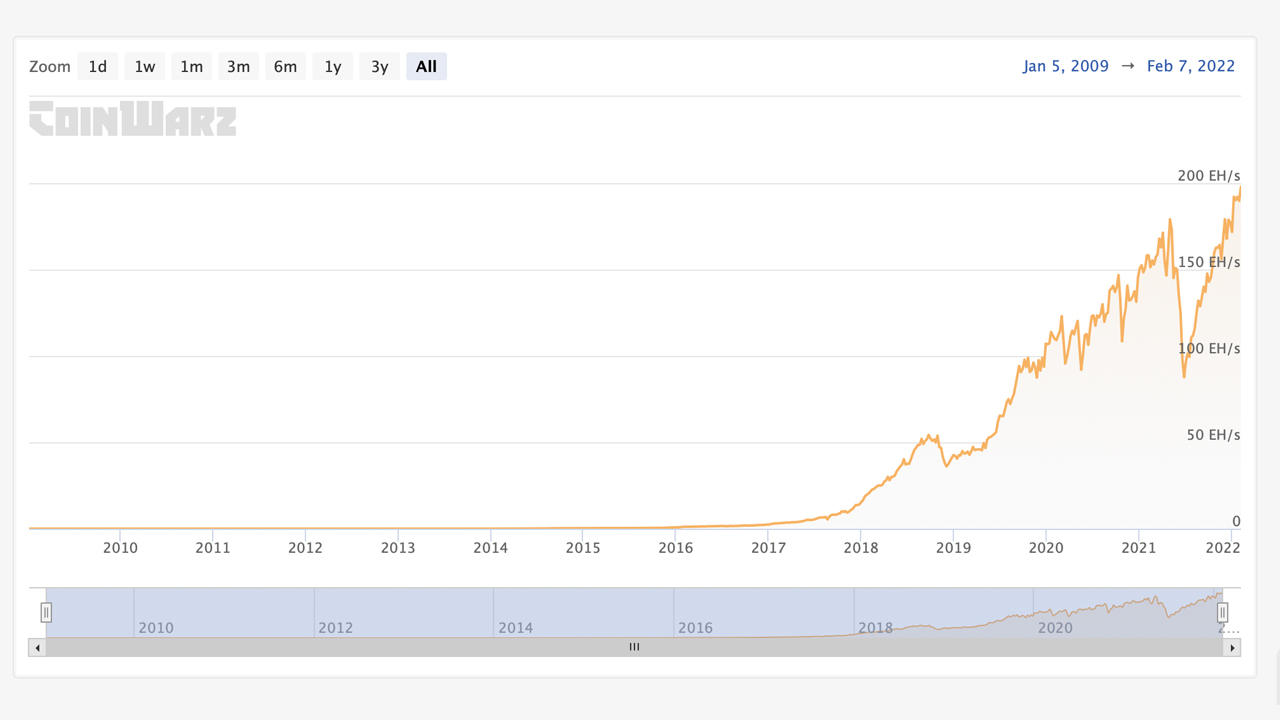

Whereas bitcoin’s value worth has climbed fairly excessive towards the U.S. greenback over the past 13 years, the community’s hashrate has additionally risen to all-time highs. Immediately, the hashrate is coasting alongside above 2 hundred quintillion hashes per second (H/s) which is rather a lot stronger than the Bitcoin community’s hashrate was on January 5, 2009. On that day, statistics present that 9 hundred forty-eight thousand H/s was devoted to the protocol’s safety. Calculations present Bitcoin’s hashrate has elevated by twenty-one quadrillion p.c — or 21,093,375,098,215,930% — since January 5, 2009.

Bitcoin’s hashrate is coasting alongside at all-time highs, however the crypto asset’s worth is 38% decrease than it was three months in the past, on November 10, 2021. This in flip has made it much less worthwhile to mine bitcoin (BTC), however nonetheless worthwhile for an honest majority of high-powered mining rigs. As an illustration, utilizing at present’s BTC alternate charges, the Bitmain Antminer S19 Professional with 110 terahash per second (TH/s) will produce $16.81 per day if the machine’s electrical prices are round $0.12 per kilowatt-hour (kWh). SHA256 machines that produce a minimum of 25 TH/s will nonetheless flip a revenue utilizing at present’s BTC alternate charge and $0.12 per kWh.

Mid-October, 2011: Bitcoin’s Worth Drops Beneath the Price of Manufacturing

Over ten years in the past, on October 18, 2011, the price of a single bitcoin fell under the value to provide bitcoin (BTC). It wasn’t the one time this has occurred, nevertheless it was one of many first occasions the value of bitcoin was mentioned to be decrease than the fee to mine the digital foreign money. That week in 2011, the community’s hashrate was round 8.596 TH/s or 8,596,000,000,000 hashes per second. Whereas the hashrate was a lot lower than at present, it was nonetheless nine-hundred-six million p.c (906,593,161.72%) increased in 2011 than on January 5, 2009.

On the time, when BTC’s value fell under the price of manufacturing, it made worldwide headlines. The Guardian’s contributor Charles Arthur wrote in regards to the incident on October 18, 2011, when he defined how BTC’s value crashed from a excessive of over $30 per unit to $1-2 per BTC in mid-October. That 12 months, Arthur known as BTC a “‘Hackers’ digital foreign money and favoured technique of alternate.” The Guardian author’s report mentioned that BTC’s value “plummeted throughout exchanges – to a degree the place it prices extra to ‘mine’ them than they’re value.”

Bitcoin’s Worth Drops Beneath Manufacturing Price in 2015, 2018, and 2020 — Estimates Say ‘Present Manufacturing Price Is $34K’

A few 12 months after the 2013 value excessive, BTC’s worth began to close dropping under the price of manufacturing once more. In the course of the first week of December, the community hashrate declined and the CEO of Spondoolies-Tech, Man Corem, defined how the crypto asset’s market worth was affecting miners on the time. “Below the present bitcoin worth, mining gear effectivity of 0.5–0.7 J/GH vary and power value, we’ll attain equilibrium very quickly,” Corem mentioned. The associated fee to mine BTC was reportedly greater than they have been value in mid-January 2015 after Corem made these statements. That month in 2015, the value of bitcoin (BTC) dropped under the $200 mark.

In keeping with experiences in mid-December 2018, BTC’s value was decrease than manufacturing prices once more. At the moment in 2018, BTC was altering fingers for $3,200 per unit. Moreover, on March 12, 2020, also known as ‘Black Thursday,’ BTC’s value shuddered and tanked all the way down to the mid-$3K vary, making it unprofitable for a majority of the community’s mining individuals. Whereas BTC’s value is 38% decrease than the all-time excessive, some consider that it’s nonetheless close to present mining prices. In mid-January of this 12 months, the favored Twitter account dubbed ‘Enterprise Founder’ informed his 14,600 social media followers that “present manufacturing value is $34K.”

Enterprise Founder additionally talked about the crypto asset’s worth crashing under the price of manufacturing in December 2018 and March 2020. “The worst dumps bitcoin ever had have been resulting from miners capitulation (Dec 2018, Mar 2020), when BTC fell under manufacturing prices, it’s in danger for miner capitulation,” Enterprise Founder tweeted. “BTC was in danger for miner capitulation at $30K in Could. The present manufacturing value is $34K,” he added.

Can Bitcoin’s All-in Sustaining Manufacturing Price Rise?

Figuring out precisely what the price of manufacturing is, and what a bitcoin miner’s all-in sustaining value is, can be extraordinarily exhausting to estimate, however there have been many who consider there’s a quantity. The aforementioned cases describing the occasions and price-points the place individuals believed the value of BTC had fallen under the fee to mine the crypto asset are an ideal instance of this perception.

For instance, whereas a miner leverages a 100 TH/s machine and will get a day by day revenue for that machine of round $16.81 per day with electrical energy costing $0.12 per kWh, one other miner may pay $0.06 per kWh. Furthermore, one examine printed in October 2020 claims that “the price of bitcoin mining has by no means actually elevated.”

What do you consider the reported cases the place it’s been mentioned that the value of bitcoin fell under the price of manufacturing? What do you consider the estimated $34K present value of manufacturing assertion? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.